Insurance Costs

Consumers typically pay the following types of costs when they have insurance.

- Premium: The premium is an amount of money a consumer pays for a health insurance plan. The consumer and/or their employer usually make this payment bi-weekly, monthly, quarterly, or yearly. The premium must be paid regardless of how many services, if any, the consumer uses.

- Cost Sharing: Cost sharing is the share of costs for covered services that consumers must pay out of pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn’t include premiums, balance billing amounts for out-of-network providers, or the cost of non-covered services. Cost sharing in Medicaid and Children’s Health Insurance Program also includes premiums.

- Deductible: The amount a consumer must pay for covered health care services received before their plan begins to pay. For example, if a consumer’s deductible is $1,000, their plan won’t pay anything until the consumer has paid $1,000 for covered health care services. A plan with an overall deductible may also have separate deductibles that apply to specific services or groups of services. For example, a plan may have separate in-network and out-of-network deductibles.

- Copayment: A fixed amount ($20, for example) that a consumer pays for a covered health care service after they’ve paid their deductible.

- Coinsurance: The percentage of the costs of a covered health care service that a consumer pays (for example, 15% of the cost of a prescription) after paying a deductible.

See Appendix A for examples of how cost sharing works.

Tips to Know:

- Sometimes consumers with most types of health insurance don’t have to pay any cost sharing for certain services. This is often true for preventive services like flu shots and some cancer screenings. The goal is to keep enrollees healthy and catch health problems early.

- Many health insurance plans have an out-of-pocket maximum. This is the most a consumer could pay during a coverage period (usually one year) for their share of the costs of covered services. After they meet this limit, the plan will usually pay 100% of the allowed amount. This limit never includes the premiums, balance-billed charges, or care that the consumer’s plan doesn’t cover. Some plans don’t count all of a consumer’s copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit.

- In the majority of situations, the most important document for tracking health insurance costs is usually called an Explanation of Benefits (EOB). The EOB is a summary of health care charges that a health plan may send after a consumer receives medical care. It is not a bill. It shows the consumer how much their provider is charging the health plan for the care they received, and the amount the plan will cover. If the plan does not cover the entire cost, the provider may send the consumer a separate bill, unless prohibited by law.

Appendix A

Examples of Health Insurance Cost Sharing

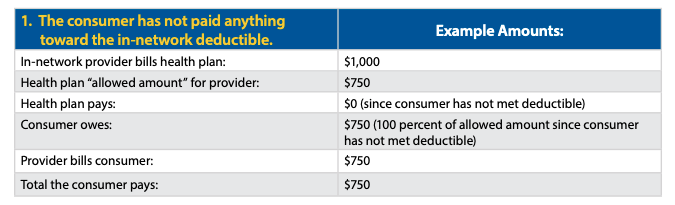

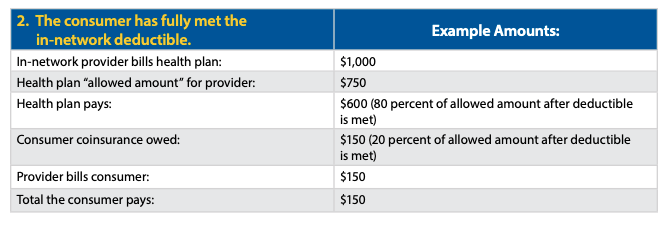

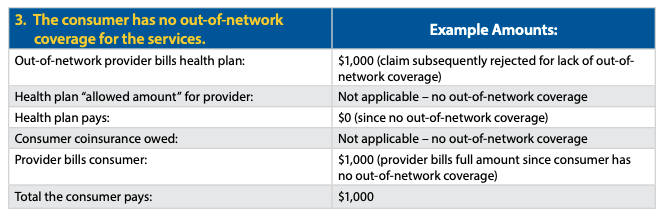

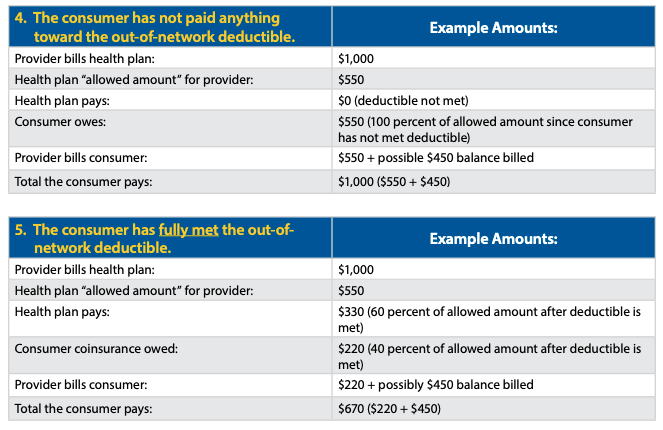

This appendix provides some examples of how health insurance cost sharing works for consumers. These examples show different outcomes depending on whether a consumer has met their deductible and whether their health insurance includes out-of-network coverage. This information is intended to illustrate some of the basic steps that are typically used to calculate cost sharing in the absence of consumer surprise billing protections (or when such protections don’t apply).

IN-NETWORK:

A consumer receives covered items or services from an in-network provider or facility.

If the services are covered by the consumer’s health plan and furnished by an in-network provider or facility, the amount a consumer pays will vary based on whether the consumer has met their in-network deductible as well as the level of their coinsurance. Note the “allowed amount” is the maximum payment the plan will pay for a covered health care item or service and is generally the basis for cost-sharing calculations. In the next two examples, assume the consumer’s health plan specifies that coinsurance is 20 percent of the allowed amount after the consumer has met a $2,000 deductible for in-network coverage.

OUT-OF-NETWORK:

The consumer receives covered items or services from an out-of-network provider.

If the covered items or services are received out-of-network, a consumer’s billed amounts will vary based on whether the consumer’s health plan provides any out-of-network coverage and whether the consumer has met their out-of-network deductible.

In some circumstances, the No Surprises Act may limit what a consumer may be billed in each of the following examples. See the No Surprises Act: Overview of Key Consumer Protections.

In the next two examples, the plan covers out-of-network services with consumer coinsurance of 40 percent after the consumer has met a $4,000 deductible for out-of-network services. If the consumer has not paid anything toward the out-of-network deductible, the provider would bill the consumer for the full amount of the charges if the charges are less than $4,000 (example 4). If the consumer has already paid their full deductible, a provider might balance bill a consumer for the difference between what the provider receives from the health plan and the provider’s initial billed amount (example 5).

Originally posted on CMS.gov